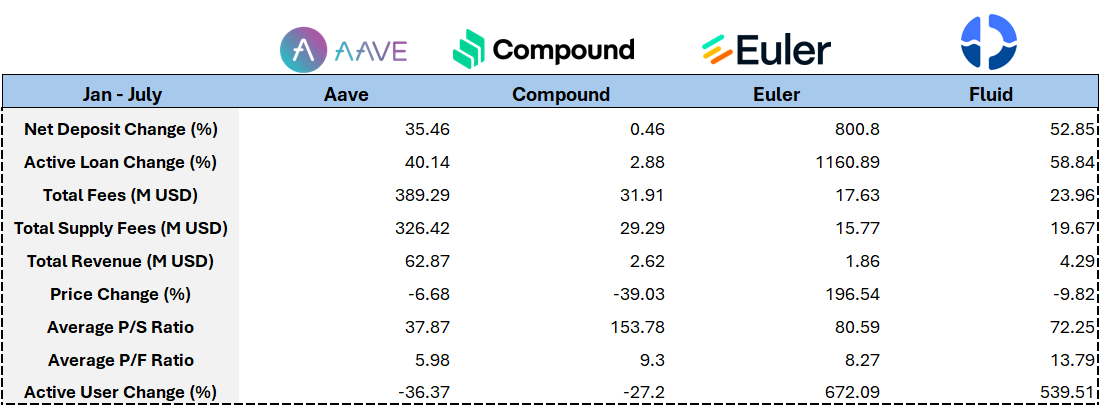

借贷协议全局分析,我来一个简单直接的版本:

(1) Aave断层领先。

(3) Euler、Fluid的增长来源于创新,各方面能力都在线,竞争压力是链上超高的流动性迁移成本,未来可期交给时间。

(2) Compound已躺平,敏感度肯定是没有的,它主打的是稳定、不改变、弱治理。

(4) 此表应加上Morpho,就完整了。

原帖很硬核,值得研究 @ChingChaLong02

Here's a hardcore analysis.

I used to just have a gut feeling that AAVE was the biggest, but I didn't realize that AAVE's income and interest expenses are 10x-20x those of several other competitors.

Is Compound really falling behind this obviously?

50.92K

140

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.