You're missing out on one of the biggest acquisitions ever made in the DeFi space

Written by: mattdotfi

Compiled by: AididiaoJP, Foresight News

Only a few people are currently paying attention to @LayerZero_Core's acquisition of @StargateFinance, but since such mergers are extremely rare, I think it's worth digging into.

Proposal Summary

LayerZero plans to acquire Stargate's tokens and treasury (backed by $0.1444 per $STG at the current rate) and terminate the Stargate DAO to merge it into a $ZRO-dominated economy.

-

Purchase price: $0.1675 per $STG, or 0.08634 $STG for every $ZRO 1.

-

The proposal will follow the standard process of the Stargate DAO and requires a minimum of 1.2 million votes and a 70% approval rate to pass.

-

The excess revenue generated by Stargate in the future will be used to reduce $ZRO circulation through buybacks.

Pros and cons analysis

This begs a key question: "Who will benefit the most?"

In the current situation, LayerZero and $ZRO holders appear to be the biggest beneficiaries, as this is a liquidity acquisition through their tokens, manifested as:

-

Acquisition of $STG backed by Stargate treasury at a modest premium of 16% while increasing the number of $ZRO holders.

-

Earn the fees generated by the protocol (approximately $1.74 million annualized, according to @DefiLlama data), which will be used to buy back $ZRO on the open market.

-

Vertically integrate $ZRO tokenomics with cross-chain business (LayerZero is leading the way) through buybacks and increase their utility.

And what do $STG and $veSTG (locked STG) holders get? Not much:

$ZRO has a low conversion discount due to its recent price increase; $STG There is only a slight premium due to market fluctuations, but the lower price limit is clear.

After an initial 24-hour discussion, LayerZero decided to pay $veSTG holders six months of Stargate revenue because they were unable to unlock the tokens before the end of the lock-up period.

Disadvantages and concerns

The problem here is complex, but in the final analysis, it lies in one word: compromise.

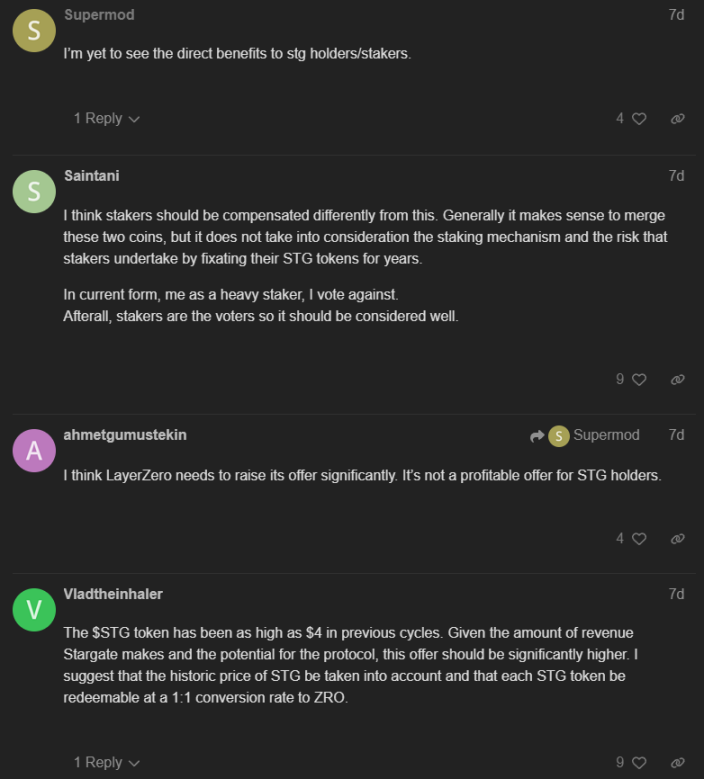

LayerZero is more profitable in the current situation, while Stargate token holders are struggling to be satisfied. Here are three major questions and uncertainties:

-

How should LayerZero's acquisition $STG be reasonably premiumed?

-

For $STG holders, how to choose between "two evils"? Should we continue to withstand the continued selling pressure of the token, or choose a safe option that lacks upside?

-

$veSTG The average lock-up period for holders is about one year, and if the proposal passes, they will only receive six months of compensation, what is the incentive?

-

$STG's current fully diluted valuation (FDV) is less than 10% of $ZRO, while $8.1 million worth of $STG is locked in $veSTG.

Many holders ask for a 1:1 exchange of $ZRO for $STG, but this is not reasonable, meaning they can instantly gain 12x returns, and LayerZero needs to use all FDV to acquire a business with a solid treasury but limited income.

Personal opinion

While I believe the LayerZero team should reevaluate the premium paid to $STG holders and design a more reasonable revenue sharing plan for stakers, this acquisition may not be a disaster for the project itself.

DAOs mainly rely on revenue and token issuance to maintain their operations, while $STG has plummeted by more than 95% from its all-time high, and Stargate, which has an annualized revenue of only $2 million, has little room to expand. In addition, Stargate already relies on LayerZero's infrastructure, making it easier to grow with its technology stack and capital after integration.

Still, I think the proposal makes sense for Stargate, but there's no need to rush to conclusions. The retention and loyalty of $STG holders to LayerZero largely depends on how the team handles the matter. Otherwise, they may lose a group of potential new $ZRO loyal holders and participants who have supported Stargate since the beginning of the project.

Update:

Theproposal has been launched on Stargate DAO, the minimum threshold has been reached, and $veSTG of the currently 2.3 million tokens in circulation (17 million in total) voted "yes" (98% vs. 2% "no").

I don't think it's a hostile takeover, but the benefits of LayerZero at this stage clearly far exceed those of $STG and $veSTG holders.