Uniswap governance is going through a transition

Participation is thinning, vote margins are tighter, and a handful of delegates now make or break proposals. That’s not necessarily a crisis, but the UAC brought it to attention in good time

Let’s walk through what’s going on 🧵

First: the basics

To pass a proposal, Uniswap needs 40M $UNI votes.

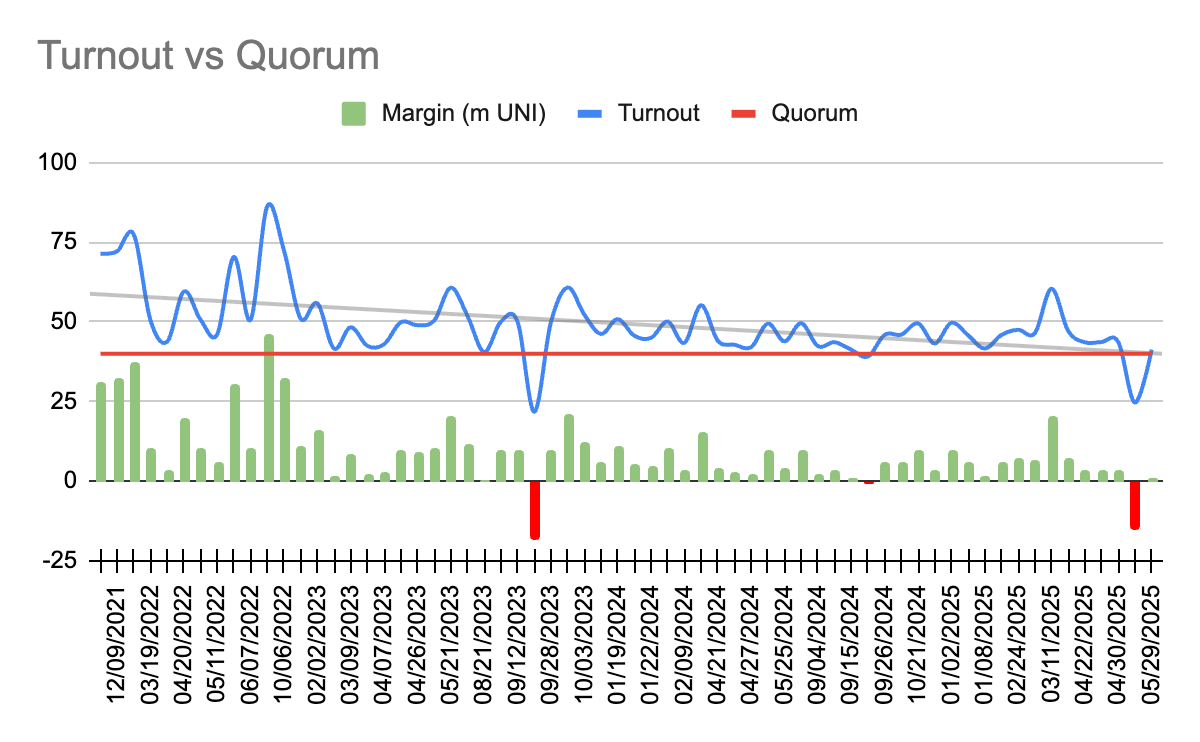

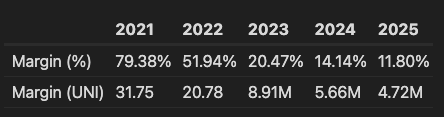

In 2021, that was easy—votes averaged 60M+.

In 2025, it’s closer to 45M.

That leaves a small margin above quorum: only ~4.7M votes, or 11.8%.

Not much breathing room.

This means quorum is no longer guaranteed.

In 2025 so far:

• 6 of 13 proposals passed with <10% margin

• 11 of 13 cleared quorum by <20%

• Just 2 proposals had a safe buffer

That’s a sign the DAO is more reliant on consistent turnout than ever.

Zoom in a bit, and the pattern becomes clearer:

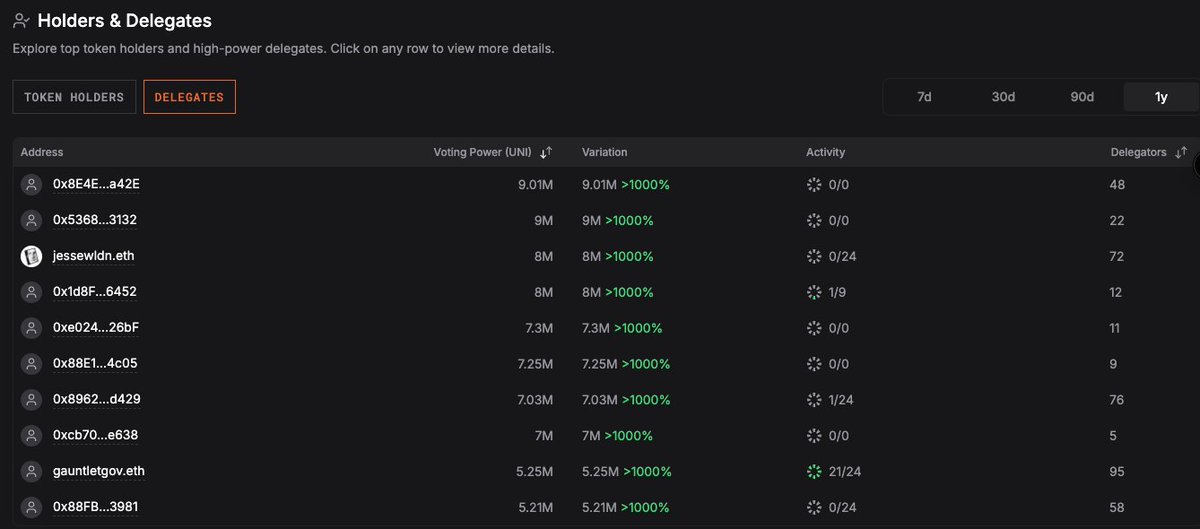

Most votes are decided by a small set of delegates—about 13 of them.

If a few redelegations happen, proposals might stall altogether.

At the same time, most top delegates don't vote at all

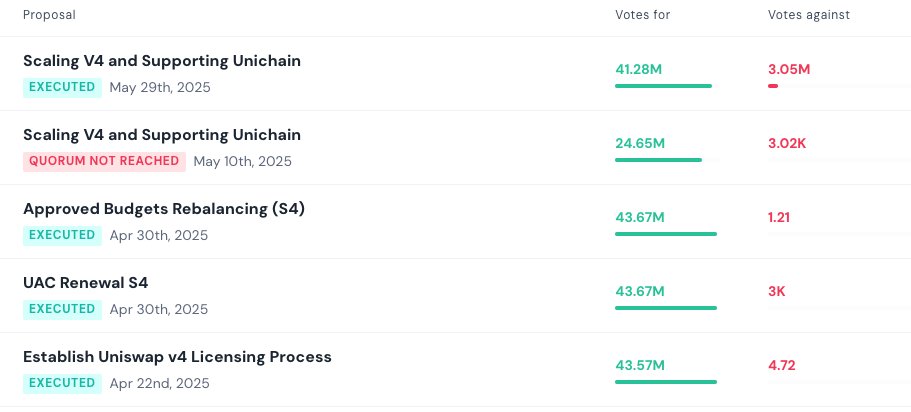

That’s exactly what almost happened recently.

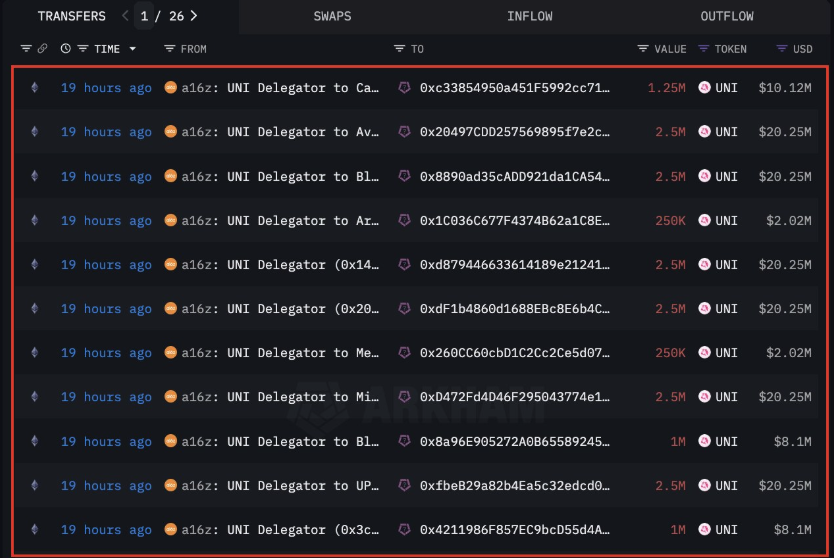

In June, a16z undelegated 20M UNI across several addresses.

Some of those delegates had been key in recent votes.

Without treasury delegations, some recent proposals likely wouldn’t have passed at all

This isn’t unusual. DAOs evolve. Voter fatigue sets in. Delegation flows change.

But the question becomes: how do we make sure governance stays functional and accessible, even as conditions shift?

Here are a few of the ideas being proposed 👇

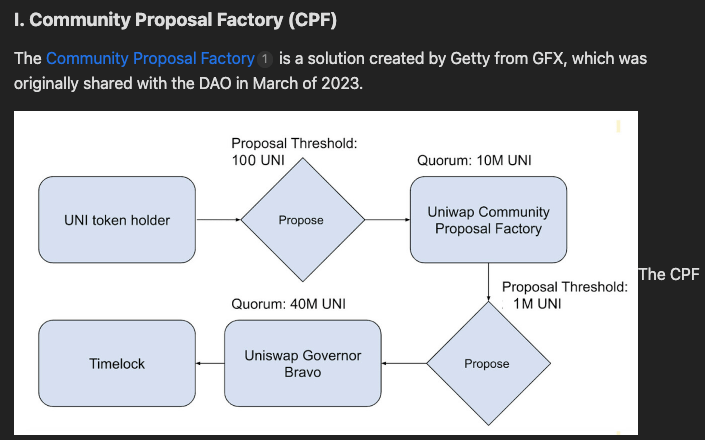

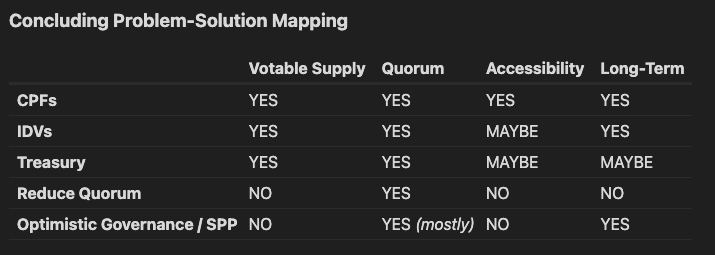

Community Proposal Factory (CPF)

A lightweight proposal flow that lowers the barrier to entry.

If a CPF proposal gets ~10M votes, it can be pushed to the main DAO for execution.

Makes it easier for smaller holders to publish ideas.

Incentivized Delegation Vaults (IDVs)

Simple: delegate your UNI, earn passive rewards.

No lockups, no custody changes.

Designed to bring more tokens into governance and reward participation without extra friction.

Treasury Delegation Round 2

The current treasury delegation (10M UNI) has helped maintain quorum.

This proposal would expand that—more UNI, more delegates, more resilience.

It’s additive, not a replacement.

These are not fixes for a crisis—they’re upgrades for a maturing system. And there are more options

Uniswap governance still works. These proposals aim to keep it working as voter attention changes, but all of them come with tradeoffs such as security or power concentration

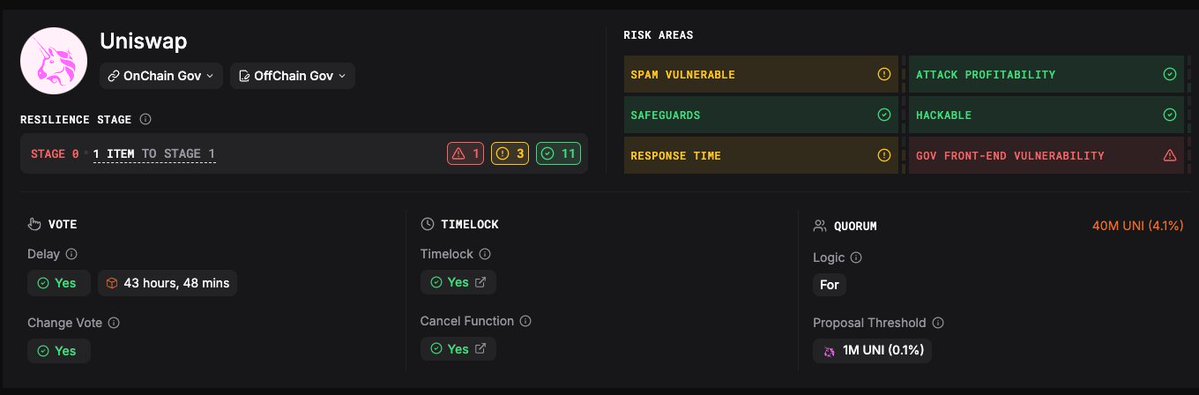

If you want more insights, Uniswap is one the DAOs we are already mapping on our governance dashboard @anticapture

We track treasury, delegated supply, active voters and more for Uniswap and ENS, to keep them accountable and find those problems ahead of time

5.483

10

Il contenuto di questa pagina è fornito da terze parti. Salvo diversa indicazione, OKX non è l'autore degli articoli citati e non rivendica alcun copyright sui materiali. Il contenuto è fornito solo a scopo informativo e non rappresenta le opinioni di OKX. Non intende essere un'approvazione di alcun tipo e non deve essere considerato un consiglio di investimento o una sollecitazione all'acquisto o alla vendita di asset digitali. Nella misura in cui l'IA generativa viene utilizzata per fornire riepiloghi o altre informazioni, tale contenuto generato dall'IA potrebbe essere impreciso o incoerente. Leggi l'articolo collegato per ulteriori dettagli e informazioni. OKX non è responsabile per i contenuti ospitati su siti di terze parti. Gli holding di asset digitali, tra cui stablecoin e NFT, comportano un elevato grado di rischio e possono fluttuare notevolmente. Dovresti valutare attentamente se effettuare il trading o detenere asset digitali è adatto a te alla luce della tua situazione finanziaria.