TRANSCEND ONCHAIN: WHAT DO WE MEAN BY IT, AND WHY ARE WE TAKING THIS DIRECTION?

With the US government announcing the ability for 401k funds (worth $12T) to enter the crypto market, the writing is on the wall: More money is coming onchain.

So it’s worth repeating what we’re doing to get Web3 ready for it.

Some numbers

A mere 5% of 401k money is $600B.

Stablecoins are projected to reach a $3.7T supply by 2030.

Onchain RWAs could be worth $30T by 2034.

Tokenized real estate has the potential to bring $380T onchain.

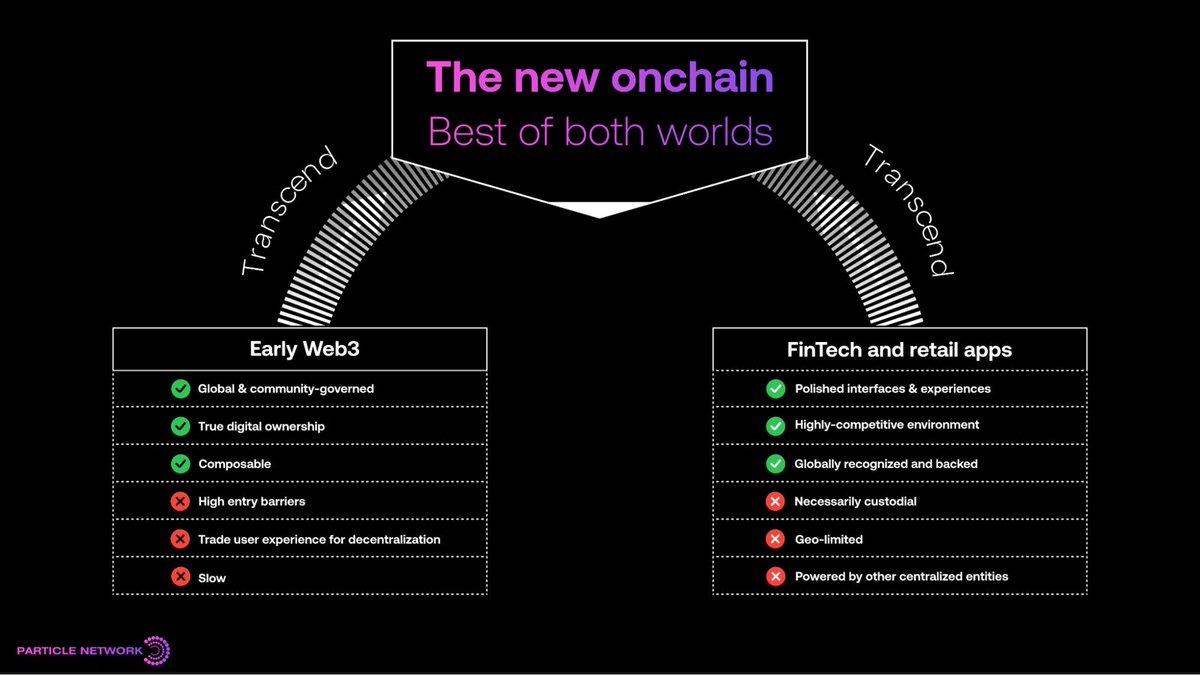

So the need is higher than ever for mainstream users to engage with dApps, and for traditional applications to integrate crypto without custody trade-offs.

Meanwhile, the tech is ready

Universal Accounts have already shown that fully non-custodial Web2-like experiences are possible, processing almost $700M in high-frequency onchain trades through UniversalX.

Thanks to this Universal Transaction Layer, Web3 is evolving into a fully-functional platform where commerce is built right into technology, making the ecosystem finally feel like one. This technology can and will enable the seamless flow of trillions in value onchain, making crypto accessible and practical for everyday use.

We’re going harder on making this happen because for Web2, this means a final upgrade.

And for Web3, it means that fairer, decentralized technology can compete directly with centralized counterparts without barriers.

But we won’t be alone in this

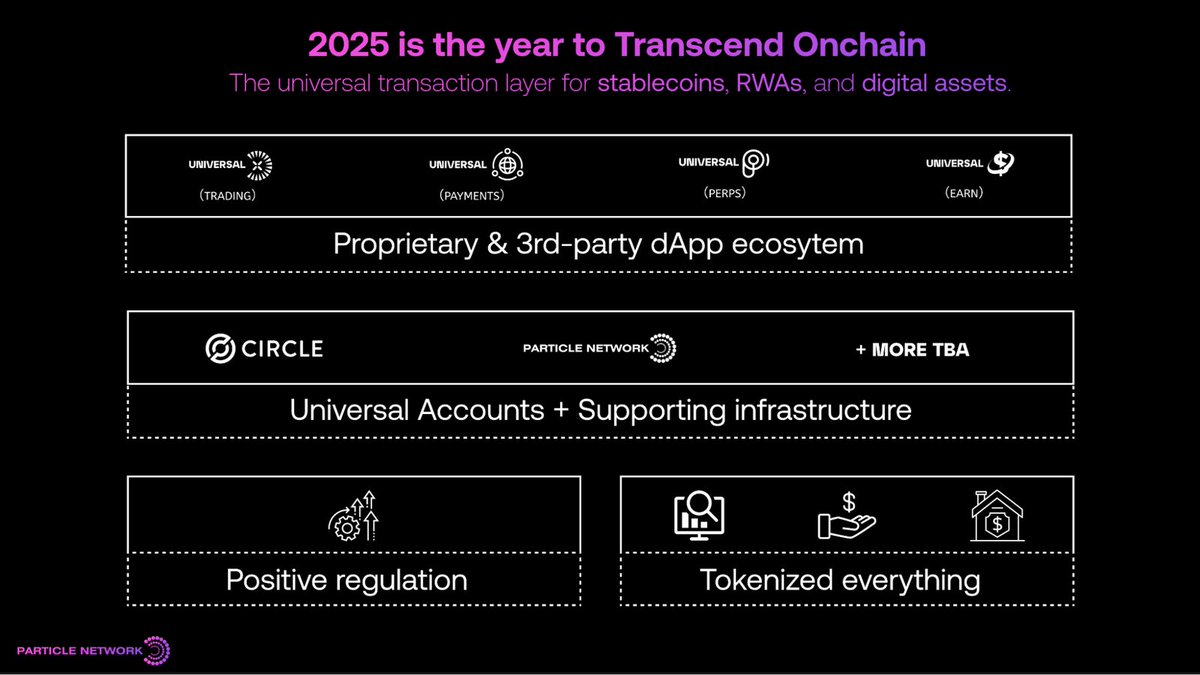

In the coming days, we’ll be announcing the early ecosystem that will constitute the Universal Transaction Layer to unify all chains.

Our first integration with Circle Gateway abstracts USDC transactions across chains. This extends to the stablecoin revolution happening across all areas of commerce.

Universal Accounts will be the infrastructure powering the world's economy. Powered by Particle Chain and $PARTI. More to come.

(This is a recap of our latest article. For a full, in-depth read, see the quoted post.)

TRANSCENDING ONCHAIN: ANNOUNCING THE UNIVERSAL LAYER FOR RWAS, STABLECOINS & DIGITAL ASSETS

The stage is set for Trillions of dollars to come into Web3.

Stablecoins may hit a $3.7T supply by 2030.

Onchain RWAs are projected to be worth $30T by 2034.

Tokenized real‑estate points at a $380T TAM.

The world is ready. Is Web3? Yes, because Universal Accounts exist.

As the only solution making Web3 feel like a single ecosystem, Universal Accounts are here to stay. They’ve already cleared $670 M via @UseUniversalX, and are the only way a multi-chain, multi-Trillion asset ecosystem can find its way to the masses—whether by accelerating Web3 or upgrading Web2.

So today, we’re announcing the culmination of our tech: The Universal Transaction Layer: a retail‑ready settlement rail for RWAs, stablecoins and all other digital assets.

Through the next weeks, we’ll also progressively announce the partners that will aid us in this mission, starting with @Circle. With the integration of Circle Gateway, we’ll be setting the stage for stablecoin settlements to occur across chains for Universal Accounts, unlocking the entire world’s economy for anyone using Universal Accounts.

When every property, dollar, or asset becomes a token, Universal Accounts become the default rails for them.

Crypto is ready. Let’s transcend onchain.

📝 Read the full vision at:

9.84K

61

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.